Get to know the Path2College 529 Plan

How Our 529 Plan Works

No matter your child’s age, the best time to open a Path2College 529 account is today. The sooner you start, the more you can take advantage of compound earnings and unique tax benefits.

Start early to make the most of your savings

Saving early has the potential to deliver compound earnings over a longer period of time.

529 fact

529 fact

Help grow your savings with gifts from friends and family using Ugift®.

Ugift is a registered service mark of Ascensus Broker Dealer Services, LLC.

Advantages of starting early

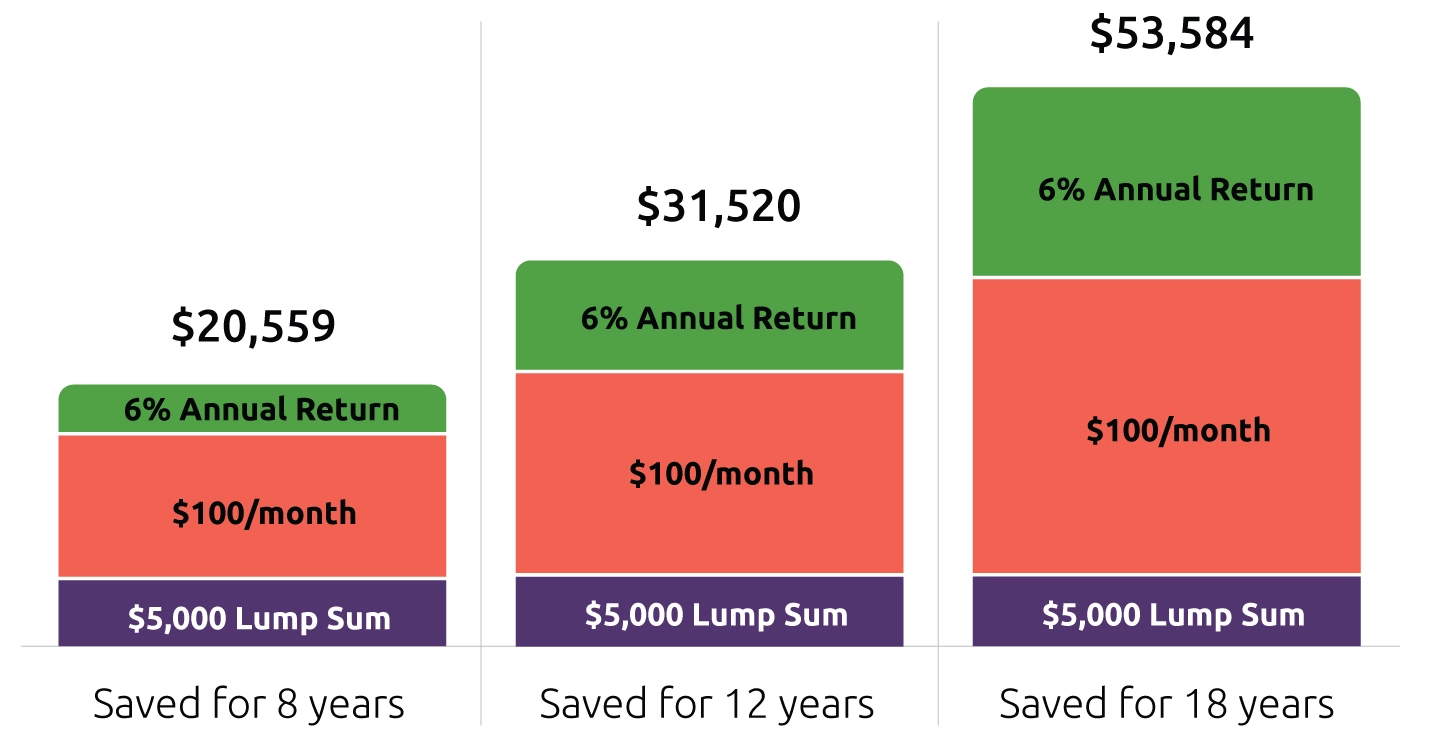

See how your savings might have grown if you started with $5,000 and continued to save $100 a month for 8, 12 and 18 years.

- Earnings

- Subsequent Contributions

- Initial Contribution

Save for 8 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $20,559

Save for 12 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $31,520

Save for 18 years

- Earnings: 6% Annual Return

- Subsequent Contributions: $100 per month

- Initial Contribution: $5,000 Lump Sum

- Total savings growth over time: $53,584

Graph Footnotes

- This chart assumes a $5,000 lump sum investment, a $100 monthly investment and 6% annual rate of return. The calculations are for illustrative purposes only, and the results are not indicative of the performance of any investments. The calculations do not reflect any plan fees or charges that may apply. If such fees or charges were taken into account, returns would have been lower. With any long-term investment, investment return may vary. Such automatic investment plans do not assure a profit or protect against losses in declining markets. Account value in the investment portfolios is not guaranteed and will fluctuate with market conditions.

How much should you save toward your child’s future college costs?

Get a quick estimate of approximately how much you’ll need to save using our calculator tool.

Estimate your savings

Unique tax benefits

When you pay fewer taxes, you can potentially save more and grow your account faster—giving your child or grandchild an even bigger head start. Path2College 529 Plan offers compelling income tax benefits.

- Georgia taxpayers filing jointly can deduct up to $8,000 per year, per beneficiary in the Path2College 529 Plan contributions from their Georgia adjusted gross income. Individual filers can deduct up to $4,000.

- Investment earnings are 100% free from federal and Georgia state income taxes when used for qualified education expenses.1

See the Path2College 529 Plan Description for more details on our unique tax benefits.

Who’s Eligible?

You, your family members, friends and more…basically anyone over 18 can open or contribute to a Path2College 529 account. Here are the details.

Account owners

- At least 18 years old with a valid Social Security Number (SSN) or Taxpayer ID Number

- Person opening the account can designate a successor account owner in the event of their death

- Certain trusts, estates and corporations can also open an account with a valid Taxpayer ID Number*

Account Owner Footnote

- *Additional restrictions may apply; please refer to the Plan Description for details.↩

Beneficiaries

- The beneficiary is the student and only needs a valid SSN or Taxpayer ID Number

- It can be your child, grandchild, yourself or a friend—you do not need to be related to the beneficiary

- Only one beneficiary per account, except when an entity creates a general scholarship account

Contributors

- Anyone can help pay for college with our easy and secure Ugift® platform

- Gifting may also provide advantages for estate and legacy planning; please consult your tax advisor2

An account can be opened in anyone’s name (like a parent, grandparent or family friend) and easily transferred later.

Qualifying expenses

With the Path2College 529 Plan, you have full control over how to use your funds. Qualified education expenses include:

- Tuition at any accredited private or public college or university, community college, technical college, graduate school and professional school across the U.S. and many abroad

- Certain room and board related expenses

- Fees, books, supplies and other equipment needed for enrollment and attendance

- Computers and related technology such as internet access fees, software or printers

- Certain additional enrollment and attendance costs for beneficiaries with special needs

- Transfer additional/leftover funds to another eligible beneficiary such as another child, grandchild or even yourself

- Pay for K-12 tuition expenses at a public, private or religious elementary, middle or high school up to $10,000 annually, both federal and Georgia tax-free

- Certain apprenticeship expenses (fees, books, supplies and equipment) for programs approved by the U.S. Department of Labor under the National Apprenticeship Act

- Repay student loans—up to a $10,000 lifetime limit per individual (including principal and interest on any qualified education loan)

Note: When funds are used to pay for K-12 tuition, registered apprenticeship program expenses or student loans, withdrawals are free from federal and Georgia income taxes. Not all states treat K-12 tuition, registered apprenticeship program expenses or student loan repayment as qualified expenses. If you are not a Georgia taxpayer, withdrawals for these expenses may be subject to state income taxes, a nonqualified withdrawal penalty, and may include recapture of any tax deductions claimed. You should talk to a qualified professional about how tax provisions affect your circumstances.

Please see the state tax treatment of withdrawals section in the Plan Description for more information.

See plan details for additional information

Have more questions?

No. Your Path2College 529 Plan funds can be used at any accredited university in the country—and even some abroad. This includes public and private colleges and universities, apprenticeships, community colleges, graduate schools and professional schools. Up to $10,000 annually can be used toward K-12 tuition (per student).1 Review a list of qualifying expenses and the state tax treatment of withdrawals for these expenses in the Plan Description.

Footnotes

- 1Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school and registered apprenticeship programs can be withdrawn free from federal and Georgia income tax. If you are not a Georgia taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

If your child ends up not needing the funds for college, you always have multiple options for your money:

- You can leave the funds in the account as there is no age limit or expiration date. For example, the choice to go to school might be a delayed decision for the intended child.

- You can transfer the funds to another eligible beneficiary, such as another child, a grandchild or even yourself.

- Up to $10,000 annually can be used toward K-12 tuition (per student).1

- Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1

- If you need to withdraw the funds for any reason, you can at any time. Earnings on funds withdrawn for a purpose other than qualified higher education expenses are subject to federal and state income tax and a 10% additional federal tax (known as the "Additional Tax"). See the Plan Description for more information and exceptions.

Footnotes

- 1Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school and student loans can be withdrawn free from federal and Georgia income tax. If you are not a Georgia taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances.↩

Your Path2College 529 Plan account can be used at eligible colleges, universities, vocational schools, community colleges, graduate or postgraduate programs, apprenticeships and more.1 Contact your school to determine whether it qualifies as an eligible educational institution or use the Federal School Code Search tool on the Free Application for Federal Student Aid (FAFSA) website.

Footnotes

- 1Withdrawals for registered apprenticeship programs can be withdrawn free from federal and Georgia income tax. If you are not a Georgia taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances.

Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

There are no sales charges, startup or maintenance fees associated with Path2College 529 accounts. For details on total annual asset-based fees, comprised of the underlying investment expenses for each investment option, the plan manager fee and state administration fee, review the Plan Fees for each individual investment portfolio.